YOUR QUARTERLY VIDEO REVIEW

Hear our thoughts on the previous quarter & your financial life.

Our 2024 Q2 Quarterly Client Update video, sent to our clients to accompany quarterly statements. Please contact your Triune Financial Planner with questions!

The Impact of AI, Pareto Principle and Staying the Course

Hello to all of Triune’s friends and clients. It’s hard to believe 2024 is more than halfway over, and we want to start by saying thank you. Thank you to those of you who have been with us since our founding in 2005, and thank you to the new clients we’ve only just begun working with last month.

We’re back with another Quarterly Video Update where we explore what’s going on in the financial zeitgeist, and as always, gain a better perspective on the market in relation to your Financial Life Plan.

Is it wise to bet on the AI big winners?

The rapid prevalence of AI amongst tech companies, and many of our every day lives, has led the charge in market returns. Namely, NVIDIA, Apple and Microsoft significantly contributed to global market returns year-to-date. NVIDIA, in particular, saw remarkable growth, briefly surpassing Apple and Microsoft to become the largest company in the world by market capitalization. This surge underscores the market’s optimism about AI and its potential to revolutionize various industries.

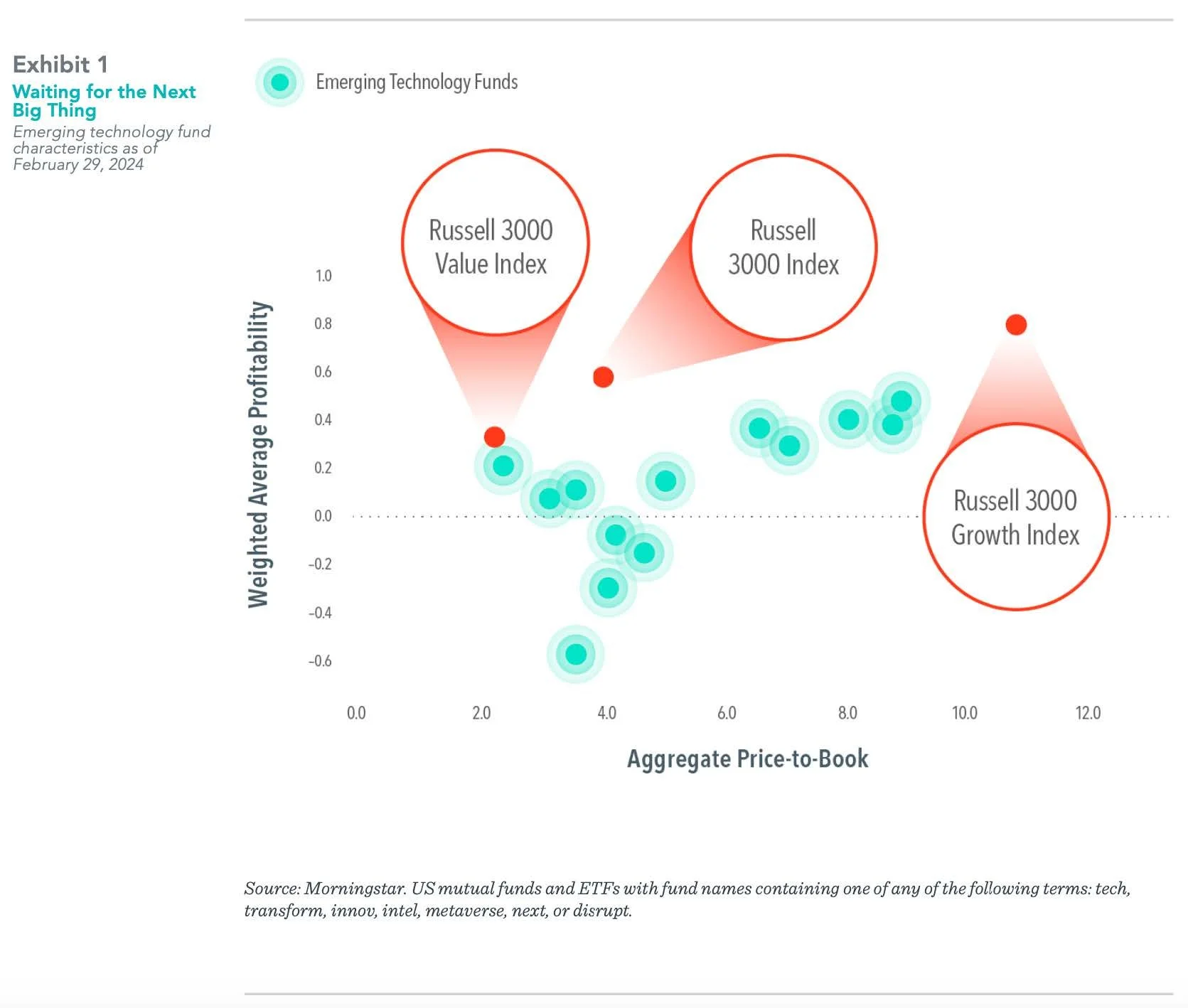

However, it is essential to approach this enthusiasm with caution. As Wes Crill discusses in his article "Looking for the Next NVIDIA May Shrink Your Return," attempting to predict the next big tech disruptor is akin to stock picking. Of course, investors with broadly diversified portfolios likely already hold many of these top performers, but for those wanting to amplify their exposure should be aware that emerging tech strategies tend to have characteristics that suggest lower expected returns. For example, of the 13 US Mutual funds and ETFs in the graph on your screen, all of them focus on emerging technology.

9 of 13 lean towards growth compared to the market, and

8 of 13 have lower profitability than the value segment of the market

As you’ll recall, value company stocks, and profitable stocks have historically outperformed growth and low-profitability, respectively.

Any time you increase the concentration of your investment portfolio into a stock or a group of stocks you are increasing the risk of your portfolio. That increased concentration may or may not result in greater returns.

So…

Instead of chasing the latest trend, maintaining a broadly diversified portfolio that captures systematic differences in expected returns is more prudent. This approach helps mitigate the risks associated with concentrated bets on specific companies or sectors, and stack the odds in your favor.

And for those of you that wonder if “things are different this time”… or, “AI is so new, might I miss out?”…

The concentration of market power in a few large firms is not a new phenomenon. Historical data reveals that dominant companies frequently change over time. The research paper from Dimensional Fund Advisors called, "Large and In Charge" illustrates that market concentration, such as the current prominence of the “Magnificent 7” tech stocks, has occurred before. For instance, IBM's dominance in 1967 was more pronounced than even Apple's position at the end of 2019. This historical perspective reminds us that while certain companies may dominate the market temporarily, their reign is rarely permanent.

The key takeaway is to remain disciplined and not let short-term market movements influence long-term investment strategies.

As we move through 2024, it’s good to zoom out. We went through a tough 2022, with market declines in every sector. Fortunately, the stock market has seen a strong recovery that started in the final months of 2023 and has continued through the first half of 2024. When looking at the 2nd Quarter alone… Emerging Markets led the way with a 5.1% return. The US Market (measured by the Russell 3000) achieved a 3.2% return, while developed markets outside the US faced a slight decline of -0.7%. The performance of value and small-cap stocks lagged behind their growth and large-cap counterparts. Despite this underperformance, profitability remained a bright spot.

These figures highlight the importance of diversification and the varying performance across global markets.

As we reflect on these developments, it is crucial to remember that your unique financial plan remains the cornerstone of your investment strategy. In fact, it is your specific “time horizons” that should be the main driver of your investment allocation. We believe the allocation of your investment funds should be based on the objectivity of your individual and specific Financial Life Plan and not on trends, emotions or what is “hot” in the market right now. Your plan identifies the timing of your need for withdrawals from your investment assets.

Have a financial need in the short-term (0-2 years)? This is Bucket #1 — and these funds should be in cash or a cash equivalent (HYSA, CD’s, etc.).

Have a need in the mid-term (3-4 years)? This is Bucket #2 — that money likely needs to be in a conservatively diversified allocation to obtain both growth and income yet have less volatility (more stability) than bucket #3.

Don’t need to touch certain funds for 5+ years? This is Bucket #3 — this money needs to be invested in a well-diversified portfolio of stocks to achieve higher expected rates of return. This allocation of your overall portfolio is where we believe you’ll see a better risk return trade-off and protect your long-term purchasing power against the devastation of inflation over the long-term.

Values & Faith

At Triune Financial Partners, we are committed to empowering you to achieve your financial goals by focusing on long-term strategies that align with your values. Our evidence-based approach to investing is designed to navigate the complexities of the market and provide you with a steady path toward financial success.

As always, one thing is certain… uncertainty. In times like this we can glean a lot from the “Pareto Principle”, or the 80/20 rule… Paraphrased, there is a “trivial many” and a “vital few”. This is why we always point you back to your planning, your goals, your values, and your faith. At the end of the day, very few things truly matter. It’s an honor for us to meet you at the intersection of your money and your values so that you can focus on the “vital few” in your life.

Thank you for your continued trust. It is an honor to work together.

Disclosures: Financial advisors are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients. Member SIPC. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against loss in a declining market. Investing involves risks including potential loss of principal and fluctuating value. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. This content is provided for informational purposes, and it is not to be construed as an offer, solicitation, recommendation or endorsement of any particular security, products, or services. Triune Financial Partners, LLC is an investment advisor registered with the Securities and Exchange Commission.