YOUR QUARTERLY VIDEO REVIEW

Hear our thoughts on the previous quarter & your financial life.

Our 2021 Q4 Quarterly Client Update video, sent to our clients to accompany quarterly statements. Please contact your Triune Financial Planner with questions!

What Should Investors Do About Inflation?

Ready or not, 2022 is off and running. As we embark upon the new year, markedly higher inflation than recent years plus three consecutive years of strong market performance are the topics we’d like to discuss with you, as they’ve been in the news a lot recently.

First, inflation…

Prices, as measured by the Consumer Price Index (CPI), rose 7% last year through December, and the probability of even higher inflation is discussed in the financial news every single day.

Photo by Engin Akyurt from Pexels

The CPI measures a specific basket of goods and services, but the impact of inflation to your personal spending may look different from the index. A few specific pockets of goods, such as energy and used vehicles, may be contributing significantly to the recent increase. FOR THIS, WE CAN USE The Core Price Index, which excludes food and energy, AND THAT rose 5.7% last year through December. AS YOU CAN SEE The effects of inflation can be nuanced and vary widely from one person or household to another.

So, what should investors do about inflation? Here is some perspective…

Prices of financial assets include expectations for inflation. Hundreds of billions of dollars of stocks and bonds are traded on an average day. Market participants incorporate their expectations around future inflation into those trades. As new information develops, they may reassess their expectations and this is what causes prices to rise or fall. Remember that current prices of stocks and bonds are always looking forward, and represent the collective expectations of future events.

History shows us that stocks have outperformed inflation over time. Over the past three decades through December 2021, the S&P 500 had an annualized return of 11.12%, and even after adjusting for inflation that return is 8.66%. A recent article Will Inflation Hurt Stock Returns? Not Necessarily from Dimensional Fund Advisors explores how in that time, there was not a reliable connection between periods of high inflation and stock returns. Meaning that high inflation is not a reliable indicator of lower or higher stock returns.

But what about periods with double digit inflation, like the 1940s and 70s? We find similar results from 1927 THROUGH 2020. Exhibit 1 shows an average 5.5% real returns (that is, the market return less inflation) in years with above average inflation for various asset classes of stocks and bonds. Each of these assets outpaced inflation except for T-Bills. (T-Bills are very short-term debt issued and backed by the full faith & credit of the US Government.)

EXHIBIT 1

“Keeping It Real”

Average annual real returns in years with above-median US inflation, 1927–2020

For those investors who are sensitive to unexpected inflation, there are options available. One option which Triune employs in client portfolios are short-duration, high-quality corporate bonds. These debt instruments are less sensitive to changes in inflation than longer term fixed income instruments.

The best answer to the question “What should I be doing about inflation?” may be boring. Timing markets around inflation expectations can be difficult and risky. Instead of trying to outguess the market, investors may find comfort learning that the market already incorporates expectations around supply chains, demand, taxes, government spending, and yes, even inflation.

Now we turn to various measures of the market that are at or near an all-time high… so doesn’t that mean the market is ready for a fall?

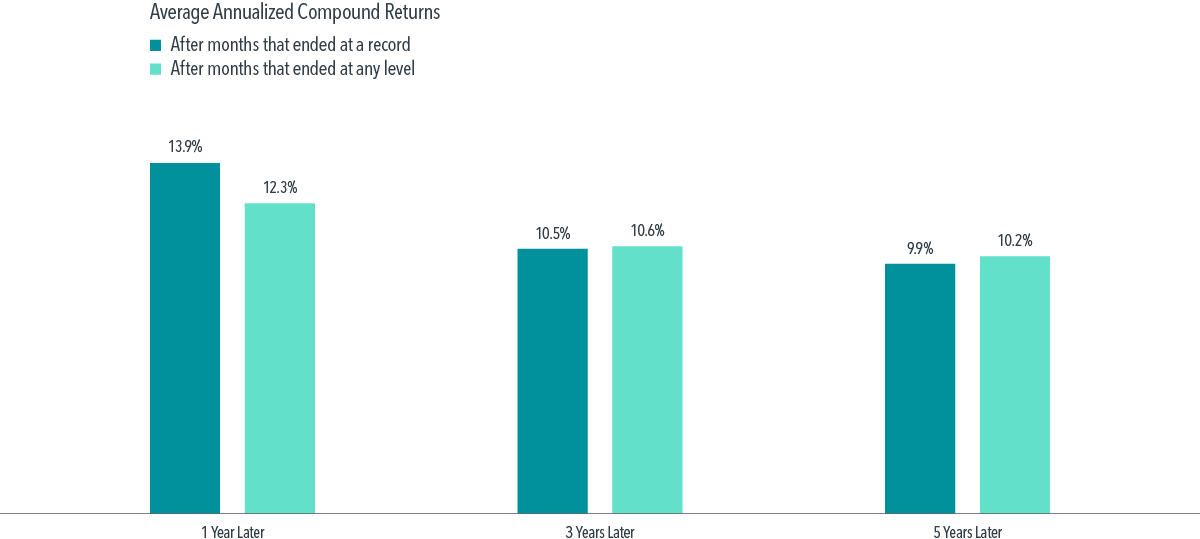

Well, many investors may think a market high is a signal that stocks are overvalued or have reached a ceiling. However, research tells us that average annual returns, after months that ended at record highs, are very similar to returns after months that ended at any level. The data shows that, over the last 96 years, the average return of the S&P 500 after months ending in a record high was nearly 14% one year later and just under 10% five years later. That closely matches the average return of any given period NOT ending in a record high. In other words, reaching a new high doesn’t necessarily mean the market will retreat, but rather that stocks are priced to deliver positive expected future returns, so regularly reaching record highs is the outcome investors should expect.

EXHIBIT 2

S&P 500 Index Returns

1926-2020

So how do these inflation trends and market peaks relate to your Financial Life Planning?

First, we account for your short, mid, and long-term goals, which are clearly identified in your Financial Life Plan. Using this data, we can determine the level of low-risk money (meaning “cash” or similarly stable instruments) to hold for your short-term goals and moderate risk money for your mid-term goals. The remainder is invested for long-term goals in a growth strategy. We review this together at least annually to help you make sound decisions based on a comprehensive view of your life rather than on current market conditions. This means that even though the stock market will have ups and downs, we are able to avoid making decisions based on short-term trends or fear-inducing headlines in the financial press.

Thank you for the opportunity to collaborate with you on your Financial Life Planning. Our purpose is to honor God by empowering people with life-changing financial counsel. We are so privileged to come alongside you on the journey.

Please do not hesitate to reach out to us with questions; we look forward to the conversation.

Disclosures: Financial advisors are responsible for evaluating investment risks independently and for exercising independent judgment in determining whether investments are appropriate for their clients. Member SIPC. Past performance is no guarantee of future results. Diversification neither assures a profit nor guarantees against loss in a declining market. Investing involves risks including potential loss of principal and fluctuating value. All expressions of opinion are subject to change without notice in reaction to shifting market conditions. This content is provided for informational purposes, and it is not to be construed as an offer, solicitation, recommendation or endorsement of any particular security, products, or services. Triune Financial Partners, LLC is an investment advisor registered with the Securities and Exchange Commission.